2021 Gene Therapy Pipeline

author: Kevin Curran PhD

updated: 8/16/2021

Rising Tide Biology presents an updated table of gene therapies on the market and in late stage clinical trials.

China was the first country in the world to approve a commercial gene therapy product. China’s regulatory body, CDFA, approved Gendicine in 2003. Gendicine delivers a p53 gene into tumor cells. As of 2020, over 30,000 patients have received Gendicine treatment for various cancers.

In 2017, the FDA approved Luxturna for U.S. patients. Luxturna is an AAV based gene therapy that treats a rare, genetic form of blindness. In 2019, Zolgensma was FDA approved to treat Spinal Muscular Atrophy. If you suffer from Spinal Muscular Atrophy, you are born without the full sequence gene for SMN in your motor neurons. Zolgensma delivers the SMN gene into motor neuron cells. As of 2021, Zolgensma is commercially available in 38 countries and over a thousand patients have received this life-saving genetic medicine.

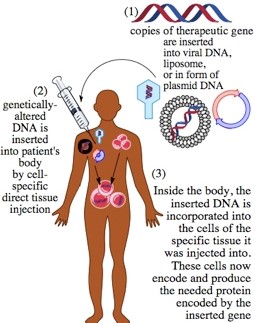

The floodgates are now open and hundreds of biotech companies are developing gene therapies. The specific details of each gene therapy are different, however the central challenge is to replace a missing or non-functional protein with a functional protein. Gene therapy achieves this goal by inserting a viable gene into the genome of the cell type that requires the missing protein.

Our table below provides an overview of many of the gene therapies in significant stages of development in 2021. Please keep in mind, our projected U.S. launch dates are merely an estimate. Delays are very common as companies seek regulatory approval.

2021 Gene therapy pipeline

| Therapy name | Company | Indication | Estimated U.S. patient population | Phase of development (projected U.S. launch) |

|---|---|---|---|---|

| Kymriah (tisagenlecleucel) | Novartis | B-cell precursor ALL, relapsed or refractory (r/r), large B-cell lymphoma | ~10,000 adult patients | FDA approved in 2017 |

| Yescarta (axicabtagene ciloleucel) | Kite/Gilead | (r/r) large B-cell lymphoma | ~10,000 adult patients | FDA approved in 2017 |

| Luxturna (voretigene neparvovec-rzyl) | Spark | RPE65 mutation-associated retinal dystrophy | 1,000-2,000 patients | FDA approved in 2017 |

| Zolgensma (onasemnogene abeparvovec-xioi) | Jaanssen Pharmaceuticals/ Johnson & Johnson |

Spinal Muscular Atrophy (Type 1) | 8,000-10,000 adult patients |

FDA approved in 2019 |

| Tecartus (brexucabtagene autoleucel) |

Gilead/Kite | (r/r) mantle cell lymphoma | ~1/200,000 | FDA approved in 2020 |

| Abecma (idecabtagene vicleucel) | BMS/Celgene | (r/r) multiple myeloma | 9,000 adult patients | FDA approved in 2021 |

| Breyanzi (lisocabtagene maraleucel) | BMS/Juno | (r/r) large B-cell lymphoma | ~10,000 adult patients | FDA approved in 2021 |

| ciltacabtagene autoleucel |

Jaanssen Pharmaceuticals/ Johnson & Johnson |

(r/r) multiple myeloma in adults |

9,000 adult patients |

Phase III (2021) |

| Tecartus (brexucabtagene autoleucel) |

Gilead/Kite | (r/r) B-precursor acute lymphoblastic leukemia in adults |

30,000 adult patients | Phase III (2021 ) |

| Instiladrin (nadofaragene firadenovec) |

KD Therapies/ Ferring Pharmaceuticals |

(BCG)-refractory bladder cancer in adults; intravesical injection |

56,000 adult patients per year |

Pending FDA approval |

| Kymriah (tisagenlecleucel) | Novartis | r/r follicular lymphoma |

86,000–100,000 adult patients |

Phase II (2022) |

| Kymriah (tisagenlecleucel) | Novartis | 2nd line treatment of adults with r/r diffuse large B-cell lymphoma | 90,000 adult patients |

Phase III (2022) |

| Yescarta (axicabtagene ciloleucel) | Kite/Gilead | 2nd line treatment of adults with r/r diffuse large B-cell lymphoma | 90,000 adult patients |

Phase III (2022) |

| Breyanzi (lisocabtagene maraleucel) | BMS/Juno | 2nd line, r/r, aggressive, large B-cell lymphoma | 90,000 adult patients |

Phase III (2022) |

| LentiD (elivaldogene autotemcel) |

Bluebird Bio | CALD in males aged less than 18 years | 700 pediatric patients |

Phase III (2022) |

| eladocagene exuparvovec (fka AAVhAADC) |

Agilis Biotherapeutics/ PTC Therapeutics |

aromatic L-amino acid decarboxylase deficiency in pediatrics; intracerebral injection |

100 pediatric patients worldwide |

Phase II (2022) |

| Zynteglo (betibeglogene autotemcel) |

Bluebird Bio | beta-thalassemia (subtypes) | 1,450 adult and pediatric patients |

Phase III (2022) |

| beremagene geperpavec |

Krystal Biotech | dystrophic epidermolysis bullosa (DEB) |

900 adult and pediatric patients |

Phase III (2022) |

| etranacogene dezaparvovec |

Uniqure | hemophilia B in adults | 1,800 adult patients |

Phase III (2022) |

| Roctavian (valoctocogene roxaparvovec) |

BioMarin | severe hemophilia A in adults | 5,300 adult patients |

Phase III (2022) |

| idanacogene elaparvovec |

Pfizer/ Spark Therapeutics |

hemophilia B in adults | 1,700 adult patients |

Phase III (2023) |

| obecabtagene autoleucel (fka AUTO1) |

Autolus | acute lymphoblastic leukemia in adults |

30,000 adult patients |

Phase I/II (2023) |

| RPL201 | Rocket Pharmaceuticals |

severe leukocyte adhesion deficiency type 1 (LAD-1) |

300 pediatric patients worldwide |

Phase I/II (2023) |

| Engensis (donaperminogene seltoplasmid) |

Helixmith | diabetic peripheral neuropathy | 7.1–13.5 million adult patients |

Phase III (2023) |

| debcoemagene autoficel |

Castle Creek Pharma | recessive dystrophic epidermolysis bullosa in patients aged 7 years and older |

400 adult and pediatric patient |

Phase III (2023) |

| EB101 | Abeona Therapeutics |

RDEB in patients aged 6 years and older |

400 adult and pediatric patient |

Phase III (2023) |

| Lumevoq (lenadogene nolparvovec) |

GenSight | Leber’s hereditary optic neuropathy, in adults with the ND4 mutation; ocular inj. |

4,500–7,500 adult patients |

Phase III (2023) |

| olenasufligene relduparvovec (fka LYSSAF302) |

Lysogene/Sarepta Therapeutics |

mucopolysaccharidosis type IIIA, also called Sanfilippo Type A |

240–1,840 patients | Phase II/III (2023) |

| PBCMA101 | Poseida Therapeutics |

(r/r) multiple myeloma |

9,000 adult patients | Phase II (2023) |

| resamirigene bilparvovec |

Audentes Therapeutics |

X-linked myotubular myopathy in males aged younger than 5 years |

40 male newborns per year |

Phase I/II (2023) |

| OTL103 | Orchard Therapeutics |

Wiskott Aldrich syndrome in pediatrics |

500 pediatric male patients |

Phase II (2023) |

| atidarsagene autotemcel (fka OTL200) |

Orchard Therapeutics |

metachromatic leukodystrophy | 400–1,700 pediatric patients worldwide |

Phase II (2023) |

| JNJ64400141 | Janssen Pharmaceuticals/ Johnson & Johnson |

respiratory syncytial virus-mediated lower respiratory tract disease in adults aged 60 years or older |

34 million adult patients |

Phase II (2023) |

| LentiGlobin (beta-globin gene therapy) |

Bluebird Bio | sickle cell disease | 58,000 adult and pediatric patients |

Phase III (2023) |

| fordadistrogene movaparvovec |

Pfizer | ambulatory patients with Duchenne muscular dystrophy |

4,000 pediatric males |

Phase III (2023) |

| giroctocogene fitelparvovec |

Pfizer/Sangamo BioSciences |

severe hemophilia A in adults | 5,000 adult patients | Phase III (2023) |

| ABO102 | Abeona Therapeutics |

mucopolysaccharidosis type IIIA, also called Sanfilippo Type A |

240–1,840 patients | Phase I/II (2024) |

| ofranergene obadenovec |

VBL Therapeutics | recurrent platinum-resistant ovarian cancer |

15,000 patients aged 15 and older |

Phase III (2024) |

| RPL102 | Rocket Pharmaceuticals |

Fanconi anemia in pediatrics | <1,000 pediatric patients |

Phase III (2024) |

| Tavo (tavokinogene telsaplasmid) |

Merck/OncoSec | advanced or metastatic malignant melanoma in adults whose cancer has progressed on a checkpoint inhibitor |

subset of the ~1.2 million living with melanoma |

Phase III (2024) |

| Zolgensma (onasemnogene abeparvovec-xioi) |

AveXis/ Novartis | spinal muscular atrophy Type 2 and Type 3 in pediatrics |

8,000 pediatric patients |

Phase I (2024) |

| ProstAtak (aglatimagene besadenovec) |

Advantagene/ Candel Therapeutics |

intermediate to high risk, localized, prostate cancer |

125,000 adult patients |

Phase III (2024) |

| Tecartus (brexucabtagene autoleucel) |

Gilead Sciences/ Kite |

r/r B-cell precursor acute lymphoblastic leukemia in pediatrics |

7,500 pediatric patients |

Phase I/II (2024) |

| verbrinacogene setparvovec |

Freeline Therapeutics |

severe hemophilia B in adults | 1,700 adult patients | Phase I/II (2025) |

| Invossa (tonogenchoncel-L) |

Kolon Group | knee osteoarthritis; intra-articular injection | 13 million adult patients |

Phase III (2025) |

| nadofaragene firadenovec |

Trizell | r/r malignant pleural mesothelioma | 2,400 adult patients per year |

Phase III (2025) |

| RGX314 | RegenxBio | neovascular (wet) age-related macular degeneration (AMD) |

2 million adult patients |

Phase III (2025) |

This table lists gene therapies in significant stages of the clinical pipeline. Many are in Phase 2 or 3, or else have demonstrated efficacy in Ph1/2 trials.

This pipeline changes quickly. I update every 3 months. Am I missing a significant development? Please let me know, you can contact me here.

Analyst reports and the CVS Health Clinical Affairs pipeline document was used as a reference in the table above.

If you’re interested in gene editing (CRISPR, ZFN, TALENS), I’ve also created this separate table of gene editing human clinical trials.

2021 update: I’ve been receiving a lot of email from people asking if a gene therapy trial is occurring for one particular disease. To help these folks, I’ve created a restricted search page on clinicaltrials.gov that only lists gene therapies. First click onto this restricted clinical trial search and then explore trials By Topic. Look for a disease in the topic list or else write in the disease on the adjacent search bar. This will provide a list of gene therapy clinical trials for one particular disease. If you see something of interest, click on a trial and you will find relevant contact information for that trial.

2021 update:

Decentralization in genetic medicine.

I am currently exploring the concept of decentralization in cell and genetic medicine. The shift to a decentralized economy and lifestyle was already underway by 2020, and then the Covid-19 pandemic accelerated this trend. We see this trend in finance, crypto, zoom calls, movement away from urban areas.

How can decentralization benefit the healthcare industry?

Medicine is becoming more personalized. Cell therapies, such as CAR-T, are perhaps the most dramatic example of personalized medicine. Blood is drawn from a lymphoma patient, their immune cells are separated out and shipped off to a central manufacturer site. A pharmaceutical company genetically modifies each batch of immune cells. These genetically engineered immune cells are then shipped back to the patient and infused back into their body. Thousands of patients have now been treated with these CAR-T cell therapies.

Could this CAR-T process be more efficient if we decentralized the manufacturing process?

What if regional hospitals and academic centers genetically engineered the patients’ immune cells on site, without shipping to a central manufacturer? This could shave many weeks off the processing time. For 3rd line cancer patients, time is critical. Many 3rd line lymphoma patients pass away while waiting for their cells to return from a centralized manufacturer. Each week eliminated in cell manufacturing time would save lives.

This 2020 article in Cancer Therapy and Prevention analyzes the potential costs savings of decentralized cell therapy.

I’ll be exploring various applications of decentralization in cell and genetic medicine in future articles. If this concept is interesting to you, then please reach out and share your thoughts.

~Kevin